Market View by SBER

Update for 11 Feb

- FNO data is mildly bullish

- SBER View

- Today at least 4 strong closely placed rejections (volume heavy rejections) are observed in range of 17570-640 in NIFTY. These nearby rejections can lead to big fall

- SBER strongly recommends to take bullish position with caution

- While below 17570, avoid bullish positions

- While above 17640, avoid bearish positions

- Next support is available at 17310-330. Below 17310, there is no strong support up to 17050

- Above 17640, there is no strong resistance until 18110

- Gap opening

- Switch to OR/VBA 1.618 levels to find trend or non-trending market in case of gap opening

- WaveNodes TF: 5min (day trading) or 15min (swing)

- Options Strategy:

- Prefer next month near OTMs for swing (OTMs carry high risk of theta decay) or weekly ITMs for day trading.

- Prices are in line with IV and greeks

- Above given view is not the buy or sell recommendation. To be validated with critical levels and Technical Analysis

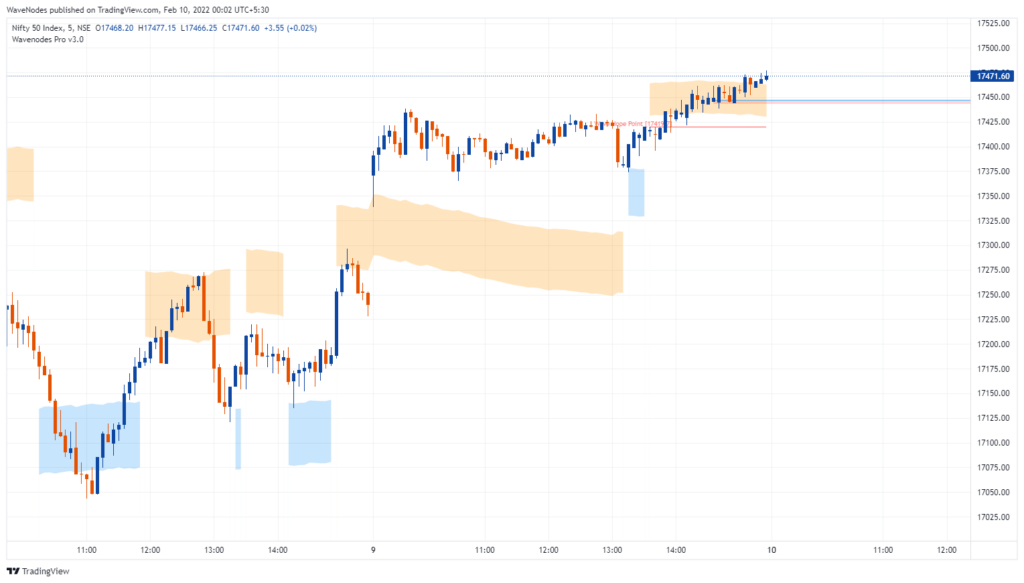

Update for 10 Feb

- FNO data is bullish

- SBER View

- No change in view given on 9 Feb

- Above range of 17350-410, market is bullish. Below this range, expect the market to remain bearish

- Gap opening

- Switch to OR/VBA 1.618 levels to find trend or non-trending market in case of gap opening

- WaveNodes TF: 3min or 5min (day trading) or 15min (swing)

- Options Strategy:

- Prefer next month near OTMs for swing (OTMs carry high risk of theta decay) or weekly ITMs for day trading.

- Prices are in line with IV and greeks

- Above given view is not the buy or sell recommendation. To be validated with critical levels and Technical Analysis

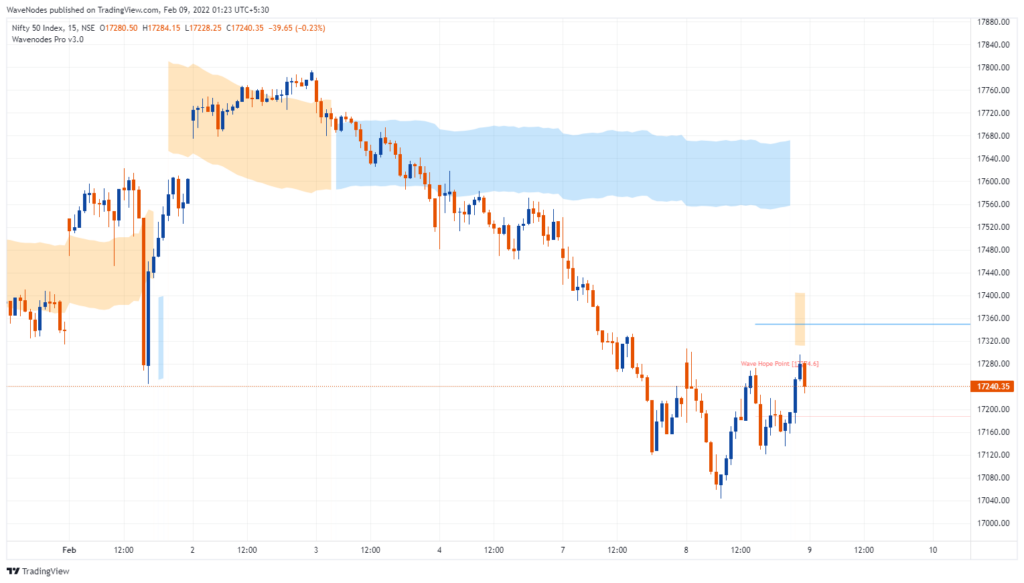

Update for 9 Feb

- FNO data is bullish. However wait for price to move above 17410. Same FNO data can become bearish if price fails to move above 17410

- SBER View

- Volumes were added in both NIFTY and BANKNIFTY

- The volume added today that hints that the market is getting ready for a big move in the coming days (see below for anticipated direction).

- Above range of 17350-410, it will give boost to bullish move. Below this range, expect the market to remain bearish.

- Closing above 17350-410, strictly bullish view

- Below 17350-410, strictly bearish view

- Gap opening

- Switch to OR/VBA 1.618 levels to find trend or non-trending market in case of gap opening

- WaveNodes TF: 3min or 5min (day trading) or 15min (swing)

- Options Strategy:

- Prefer next month near OTMs for swing (OTMs carry high risk of theta decay) or weekly ITMs for day trading.

- Prices are in line with IV and greeks

- Above given view is not the buy or sell recommendation. To be validated with critical levels and Technical Analysis

Update for 8 Feb

- FNO data is mildly bullish in BANKNIFTY and neutral in NIFTY

- SBER View

- While the BANKNIFTY is green, avoid taking sell side trades in NIFTY

- While BANKNIFTY is red, avoid any long position in NIFTY

- No bullish trades are recommended as of now in NIFTY

- While NIFTY is below Yellow Cloud Breakout, avoid taking long unhedged trades

- Next support is available at 17080, followed by 16780

- Next resistance is available at 17520 (no sell side position recommended above this level)

- Best entry points are at reversal of price from yellow clouds (with stop between 20-30 points range)

- Gap opening

- Switch to OR/VBA 1.618 levels to find trend or non-trending market in case of gap opening

- WaveNodes TF: 5min (day trading) or 15min (swing)

- Options Strategy:

- Prefer next month near OTMs for swing (OTMs carry high risk of theta decay) or weekly ITMs for day trading.

- Prices are in line with IV and greeks

- Above given view is not the buy or sell recommendation. To be validated with critical levels and Technical Analysis

Update for 7 Feb

- FNO data is mildly bullish

- SBER View

- As per WaveNodes, the market is in consolidation mode on 5 min TF

- Next support is available at 17400 followed by range of 17280-380 (strong support range on multiple TFs)

- Next resistance is available at 17660-780

- While in the range of 17280-17780, the market is likely to remain range bound on higher TF

- No bullish position is recommended while the market is below 17660 (day closing basis)

- Above 17660, the market is expected to re-test 18080

- Below 16780 closing, the market might test 16200, followed by 15900

- Gap opening

- Switch to OR/VBA 1.618 levels to find trend or non-trending market in case of gap opening

- WaveNodes TF: 5min (day trading) or 15min (swing)

- Options Strategy:

- Prefer next month near OTMs for swing (OTMs carry high risk of theta decay) or weekly ITMs for day trading.

- Prices are in line with IV and greeks

- Above given view is not the buy or sell recommendation. To be validated with critical levels and Technical Analysis

Index Management

- Index management on Daily TF – OFF

- Phase – NA

- Status – NA

DISCLAIMER AND DISCLOSURE

Trade after careful diligence. Strictly follow technical analysis (ref to videos on our channel if you are new to trading). Please read the risk disclosure and disclaimer at https://www.sachinbhatia.com.

Kindly note that the “Market View” published by the SBER is strictly for the personal use of the subscribers. Distribution in any form, in part or full, and through any medium is a violation of fair use and that of SBER’s right to exercise copyright over its work and is prohibited.