Multi timeframe (MTF) trading is a common technique used by the pullback trader to find good and safe trades by validating trend and opportunities with help of a minimum of 2 close time frames. Although this is not mandatory and one can continue to stay with a single time frame.

Think of a scenario when a trader wants to enter a good looking opportunity but it is giving conflicting signals at a different timeframe.

Normally it is recommended to stay with the timeframe that a trader uses 80% times. But,

This is not applicable in pullback trading.

A pullback on a higher time frame can become an opportunity on a lower timeframe which will be shortlived (until pullback is not completed). And an opportunity for a lower time frame might become a change in the trend on a higher timeframe. Thus, it’s very important for the trader to know well about pullback opportunity before entering the trade.

What to do in such a case?

- Remember that such scenario arises in two cases – Either it is a pullback on a higher timeframe or it is the trend changing on a higher time frame. In both scenarios abrupt and indecisive moves and traps are expected. Thus such opportunities are short-lived and might bring higher risk.

- Since the risk is high, the trade has to be timed and should be carried with low-risk exposure.

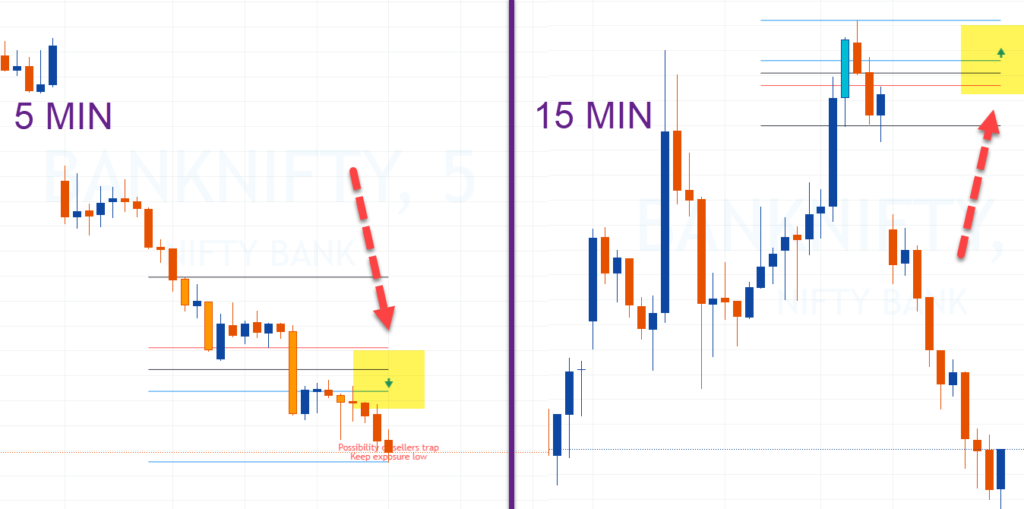

- Switch to a higher timeframe, change candle type to “Heikin-Ashi” (Assuming it is bullish on the higher time frame and bearish on lower time frame as shown in the image above. Vice-versa in case of reverse opportunity):

- Switch to a higher timeframe (here 15 minutes)

- Is the colour of the candle the same as that of the direction of opportunity on the lower time frame

- Is the body of the new candle below the body of the previous candle

- Is current HA candle within 2-3 candles from candles of the opposite colour

- If the answer to all above is “Yes”, switch back to a lower timeframe for trade (here 5 minutes). If the answer to any of the above question is “No”, stay back with the opportunity in the higher time frame.

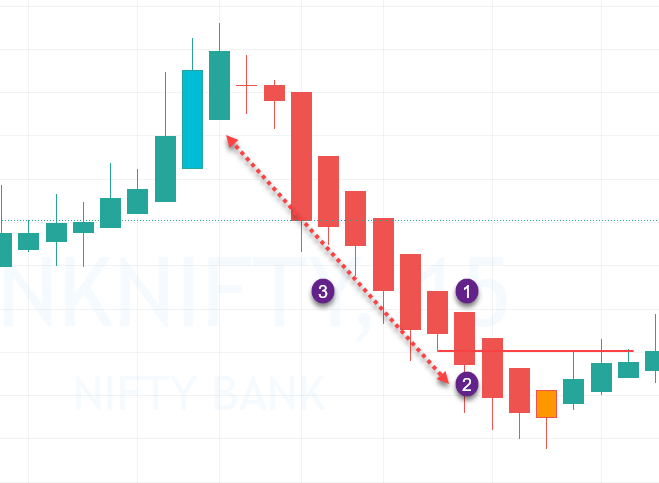

Analysis as per the image below (opportunity evaluation as per the image above that has different opportunities at 5 Min and 15 Min):

15min TF will be used (higher of 5 min or 15 min) for decision making.

Candles type switched to Heikin Ashi

Step 1 in the image: The body of the candle is red and it matches opportunity on 5 min TF

Step 2 in the image: The body of the candle has closed below the close of the previous candle.

Step 3 in the image: But it is not within 2-3 candles when compared to the last green candles on the chart.

Thus, the test failed and the trader needs to wait for either Higher TF to show a bearish trend or Lower TF shows a bullish trend i.e trend alignment.

What are the timeframes that can be checked together by MTF trader?

For day traders, 5 min and 15 min time frame are common for trading and can be used for MTF

For swing traders, although this is not much important but a combination of 1 hour – 15 min or 1 day – 1 hour can be used for MTF

For investors, it can be 1 week or 1 month with 1 day time frame depending on expected length of investment.